FASB issues standard on income statement expenses sought by investors

An income statement is an important financial report that provides rich information on how a business or company is doing and how it’s likely to perform in the future. Used in both managerial and financial accounting, it is an invaluable resource to internal and external stakeholders alike. Because of the summer solstice how complex the operations involved in a multi-step income statement are, operating revenues and operating expenses are separated from non-operating expenses and revenues. Moreover, Losses and Gains are not usually recorded as such in this kind of statement but fall under one of the above categories.

Adjustments and Expense Management

Therefore, if you are planning to grow, the investors will want to know that your business is stable and making profits. The Income Statement may be presented in a separate report and another report for Statement of Comprehensive Income can be prepared to show the additional other comprehensive income. International reporting standards now required a Statement of Comprehensive Income rather than just an Income Statement.

- Jason’s firm, Notion CPA, is an accounting firm with a business-first focus.

- Gross profit is calculated by subtracting cost of goods sold from net sales.

- Below is a video explanation of how the income statement works, the various items that make it up, and why it matters so much to investors and company management teams.

- By understanding the income and expense components of the statement, an investor can appreciate what makes a company profitable.

- By regularly analyzing your income statements, you can gather key financial insights about your company, such as areas for improvement or projections for future performance.

- This includes operating income, other net income, interest-linked expenses, and applicable taxes.

FASB issues standard on income statement expenses

For a real-world example, let’s look at Microsoft Corporation’s June 2024 Income Statement as reported to the Securities and Exchange Commission (SEC).

Preparing the Cost of Goods Sold Statement

Non-operating expenses are the costs from activities not related to a company’s core business operations. The multi-step income statement reflects comprehensively the three levels of profitability – gross profit, operating profit, and net profit. Finally, using the drivers and assumptions prepared in the previous step, forecast future values for all the line items within the income statement. For example, for future gross profit, it is better to forecast COGS and revenue and subtract them from each other, rather than to forecast future gross profit directly. The statement is divided into time periods that logically follow the company’s operations.

Examples of Items Appearing in the Income Statement

For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. Income statements are important because they show the overall profitability of a company and help investors evaluate a company’s financial performance. Income statements can also be used to make decisions about inorganic or organic growth, company strategies, and analyst consensus. An income statement is one of the most important financial statements for a company.

How confident are you in your long term financial plan?

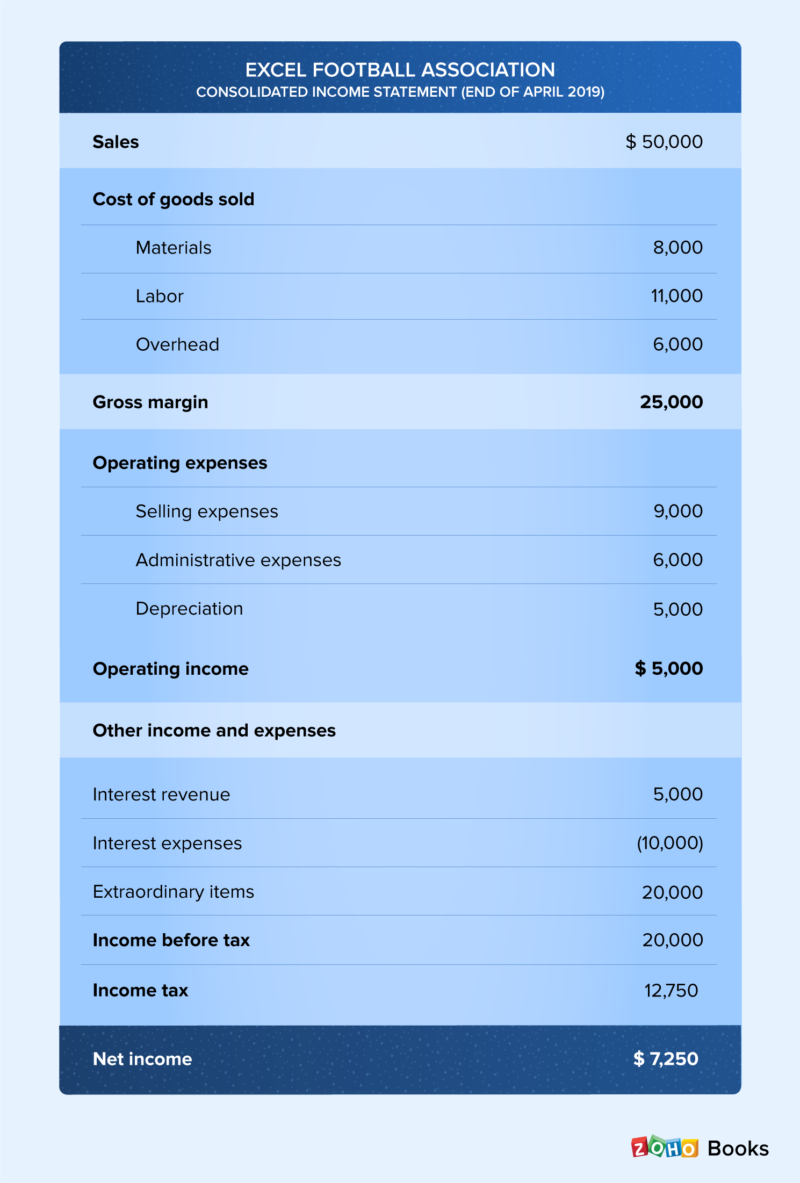

An income statement presents the revenues, expenses, and resulting profit or loss of a business. This information is presented for a reporting period, which is typically for one month, one quarter, or one year. An income statement is one of the three components of a complete set of financial statements, where the other two reports are the balance sheet and statement of cash flows.

Jason Ding is a seasoned accountant with over 15 years of progressive experience in senior finance and accounting across multiple industries. Jason’s firm, Notion CPA, is an accounting firm with a business-first focus. The firm specializes in preparing personal and corporate taxation while providing fractional CFO work and leading the accounting and finance function for several small-to-medium-sized businesses. In his free time, you’ll find Jason on the basketball court, travelling, and spending quality time with family. To calculate income tax, multiply your applicable state tax rate by your pre-tax income figure.

Revealing what’s working and what’s not in regard to revenue and expenses, the income statement tells us how we’re performing. So, we’ve got our financial statements, but sadly, sometimes the numbers aren’t the whole picture. Multiply the applicable tax rate by the pre-tax income number to arrive at the income tax expense. Enter this amount below the pre-tax income number, and also record it in the accounting records with a journal entry.

Income statement, profit and loss statement, or statement of financial performance, is one of the four financial statements which shows the company’s financial performance over a period of time. It is prepared by following the applicable accounting standards such as US GAAP, IFRS, or Local GAAP. It is usually prepared at the end of the accounting period, which could be monthly, quarterly, or annually. An income statement is a financial statement that lays out a company’s revenue, expenses, gains, and losses during a set accounting period.